If you run a small or medium business and are searching for smart yet easy accounting options, this blog is for you. Odoo Accounting is a perfect match for small and medium businesses.

Wonder why? Small and medium businesses (SMEs) have unique accounting requirements. SMEs look for simple, affordable, and flexible accounting solutions. Any employee should be able to use it without expert knowledge. Since Odoo Accounting is a part of the Odoo business ERP system, it also integrates well with other business functions like sales, HR, inventory, and payroll. With professional odoo implementation services, businesses can set up and customize these modules seamlessly. Odoo is simple, powerful, and affordable

You can track every rupee, manage bills, and follow up on payments with the help of this ERP. You do not need a separate finance department or expensive software.

Key Features of Odoo Accounting

Odoo Accounting offers amazing features to reduce manual work and improve financial accuracy.

1] Bank Synchronization: You can now connect your Odoo account to your business's bank account. With the help of odoo api integration services, this allows you to import bank statements automatically. Say bye to manual hustles as Odoo integrates with over 28,000 banks from all around the world. No more downloading and uploading bank files. You can keep all your transactions up-to-date with this real-time sync.

2] Automated Invoicing: You can create and send invoices with just a few clicks. Odoo also tracks if the customer has viewed the invoice and sends reminders for due payments. Odoo Accounting is a good option for SMEs because it has features such as AI-powered invoice digitization and instant invoice-draft. With odoo AI integration, these processes become even smarter and more automated, saving time and offering a variety of invoice templates. You can invest this time in other important business operations..

3] Multi-Currency Support: If you deal with international clients or vendors, Odoo can be a good fit for your business. It handles different currencies and uses real-time exchange rates. It also auto-converts currency values and keeps all your financial reports accurate.

4] Smart Reconciliation: You can match your bank transactions with existing invoices and payments with Odoo. This automatic reconciliation reduces errors and saves hours of manual checking. It also alerts you if something doesn’t match and suggests reconciliation from the invoices.

5] Real-Time Reporting: Odoo offers a complete set of financial reports. These reports have details like profit and loss, balance sheets, cash flow, aged receivables, and tax reports. These are updated in real-time so that you can make the right business decisions.

6] GST and Tax Management: The good news is that Odoo supports GST integration for Indian businesses. You can track tax amounts on invoices and file returns on time. Stay compliant with tax rules and reduce the burden of monthly filings with Odoo.

Hire Bizople to Implement Odoo Accounting for Your SME Growth

Get expert Odoo developers from Bizople to set up smart accounting tools that simplify finance and boost business efficiency.

Seamless Integration with Other Odoo Modules

Odoo’s biggest strength is its design. It connects easily with sales, inventory, CRM, payroll, etc.

● You can generate invoices automatically and reflect them in accounts when a sale is confirmed.

● You can record purchase and stock movements along with costs.

● You can track customer payments and dues directly from the CRM system.

● You can automatically manage salaries, expenses, and tax deductions.

● Watch supplier bills and payments sync with accounts in real time.With this integration, you can understand your business's performance.

You can skip using multiple software or re-enter the same data using different tools.

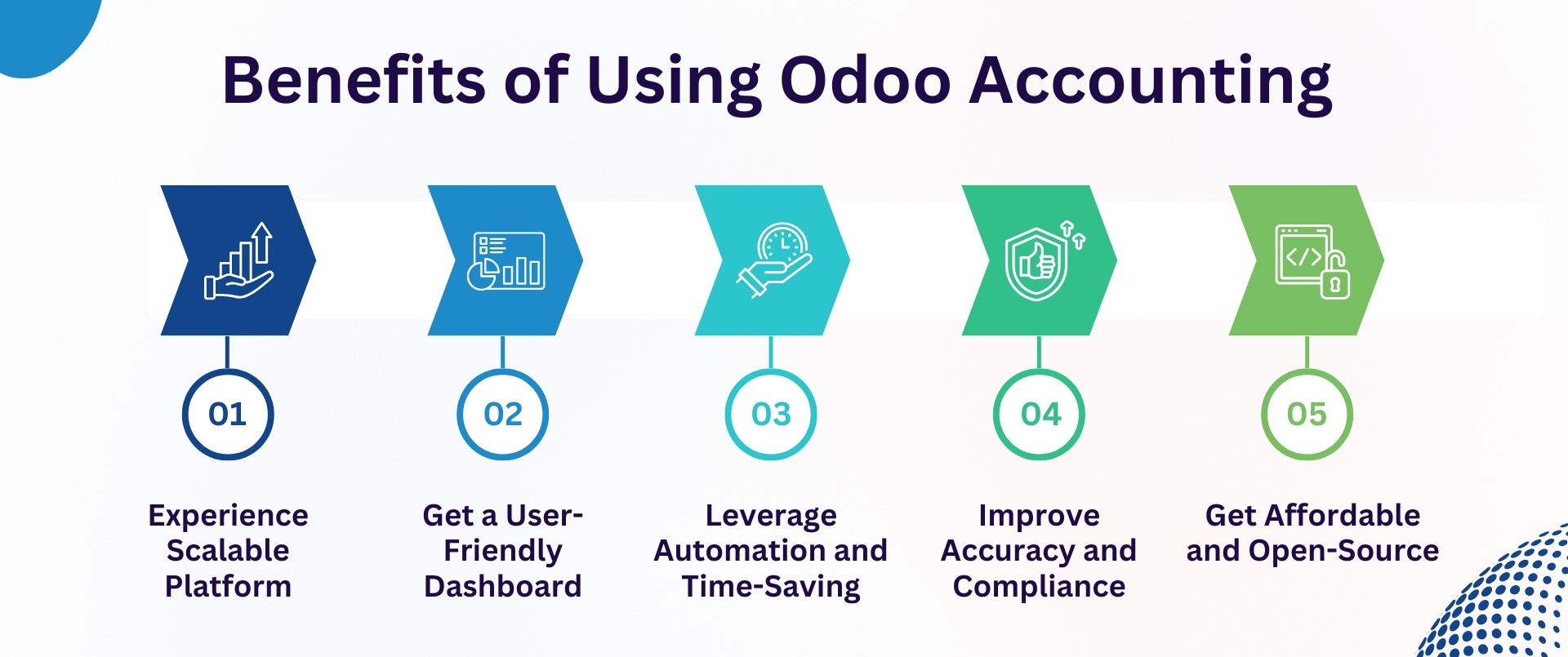

Benefits of Using Odoo Accounting for SMEs

Odoo is built for SMEs. It listens to the requirements of small businesses and helps them.

A] Experience Scalable Platform: Whether you are managing 5 employees or 500, Odoo scales with your growth. You can start with the accounting module and purchase others as needed. Odoo has other modules like HR, inventory, and e-commerce.

B] Get a User-Friendly Dashboard: Odoo's interface is clean and simple. Your team can easily learn how to generate invoices, manage expenses, and download reports. You need not hire finance experts. Save training time and avoid confusion.

C] Leverage Automation and Time-Saving: Repetitive tasks like sending invoices, payment reminders, bank reconciliation, and report generation can waste time. You can automate these tasks with Odoo. Reduce human errors and free up your team to focus on growth and strategy.

D] Improve Accuracy and Compliance: You can track every transaction, apply correct tax codes, and maintain clean records. You can also easily audit all financial activity. File your taxes with accurate reports.

E] Get Affordable and Open-Source: There are multiple expensive accounting systems in the market. Odoo’s pricing is flexible. You only pay for the modules you use. Also, its open-source version gives access to the code, so you can customize it if needed. The Bizople team can help you with odoo customization services.

Streamline SME Finances with Bizople’s Odoo Accounting Experts

Hire Bizople’s Odoo specialists to manage invoices, payments, and reports with Odoo Accounting tailored to your SME needs.

Why Choose Odoo Accounting Over Traditional Software?

Traditional accounting software are perfect for basic tasks. These tools may lack integration and modern functionality. Odoo is like your business's soulmate- it connects every part of your business and gives you full control with clear data in one place.

Here’s how Odoo stands out

● You can use it from anywhere, on any device.

● You can receive regular updates with new features and security improvements.

● You can get multi-user access with role-based permissions. Why Hire Bizople for Odoo Accounting?

Using Odoo’s accounting features is easy and anybody can learn it in no time. But when SMEs like yours decide to uplift their business operations, customization is needed. That’s where our Bizople team enters. We have helped 350+ businesses globally to use and customize Odoo. If you are looking for precise Odoo Accounting simplification, you can contact us.